Access ARK Invest Crypto Portfolios through Eaglebrook

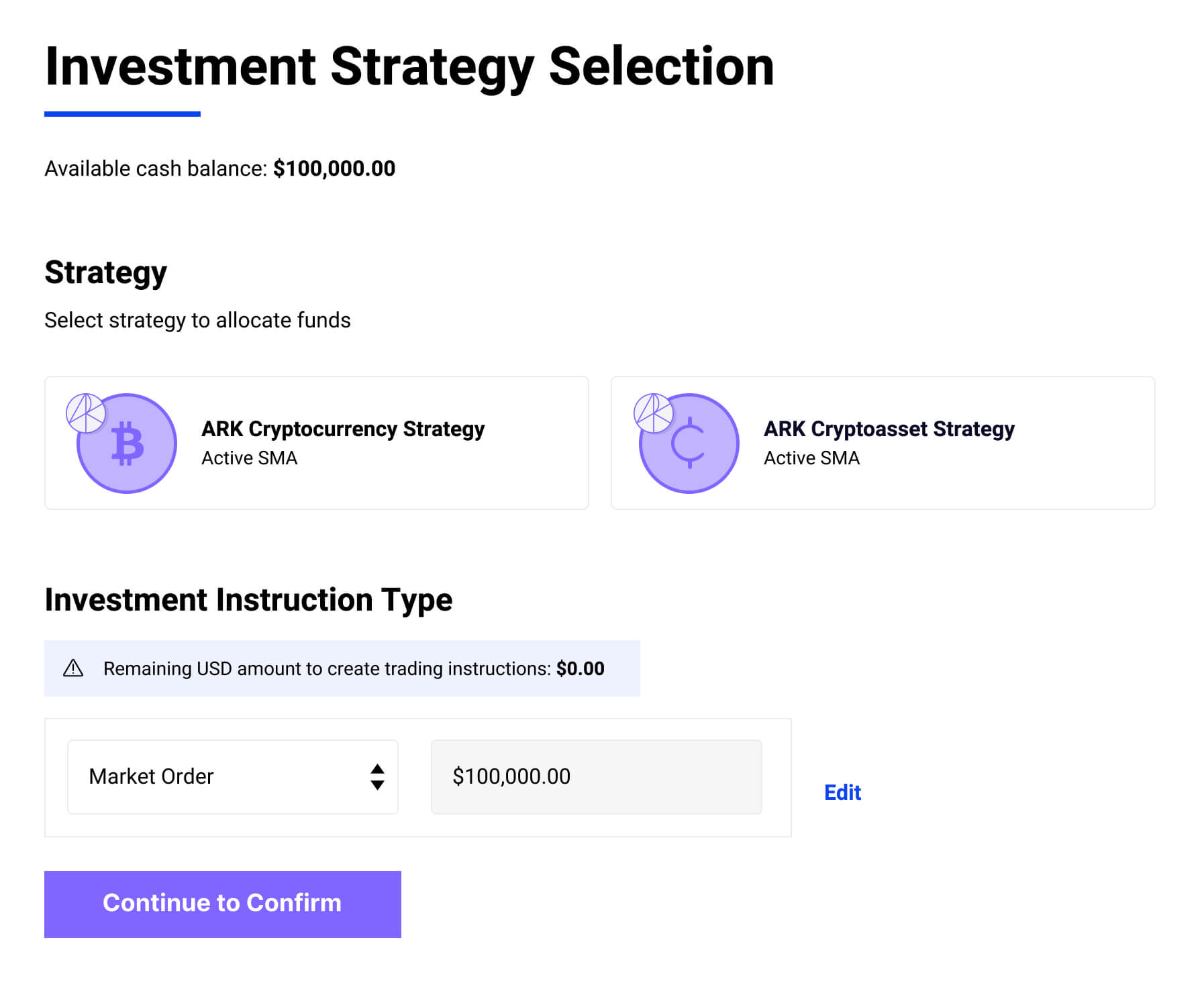

ARK Invest (ARK) and Eaglebrook have partnered to offer two actively managed digital assets investment portfolios to the wealth management industry. These strategies will be separately managed accounts (SMAs) that offer direct ownership, low minimums, and portfolio reporting integration among other benefits. ARK is serving as a non-discretionary model provider to Eaglebrook. This partnership combines a best-in-class technology-driven investment platform with ARK’s established digital asset experience to deliver a differentiated, turnkey investment solution.

ARK focuses solely on offering investment solutions to capture disruptive innovation. ARK has researched the crypto space since its founding in 2014, and has been actively engaged in crypto related equity investments since 2015. A dedicated Crypto team within ARK manages these active portfolios utilizing a defined investment and risk management framework which seeks to capture alpha through macro evaluation, on-chain analytics, sentiment, and technical factors.

ARK Cryptocurrency Strategy: A Monetary Revolution

According to ARK's research, the market capitalization of cryptocurrencies still represents a fraction of global assets and will scale to ~$30 trillion by 2030. Untethered from traditional systems and, generally uncorrelated to the behavior of other asset classes over longer time horizons, cryptocurrencies could serve as a strategic allocation in well-diversified portfolios.

ARK’s Cryptocurrency Strategy is an actively managed, high conviction portfolio invested primarily in Bitcoin and Ethereum, the largest cryptocurrencies by network value.

Documents

ARK Cryptoasset Strategy: A Financial and Internet Revolution

Public blockchains are powering novel forms of coordination across finance and the internet. These forms of coordination are likely to impact all asset classes. Just as the internet turned information into packets online, ARK believes public blockchains are likely to turn all assets into transactions on-chain.

ARK’s Cryptoasset Strategy is an actively managed, high conviction portfolio of cryptoassets that are relevant to major themes identified by ARK, including Smart Contract Networks, Decentralized Finance, Web3, and Infrastructure & Scaling.

Documents

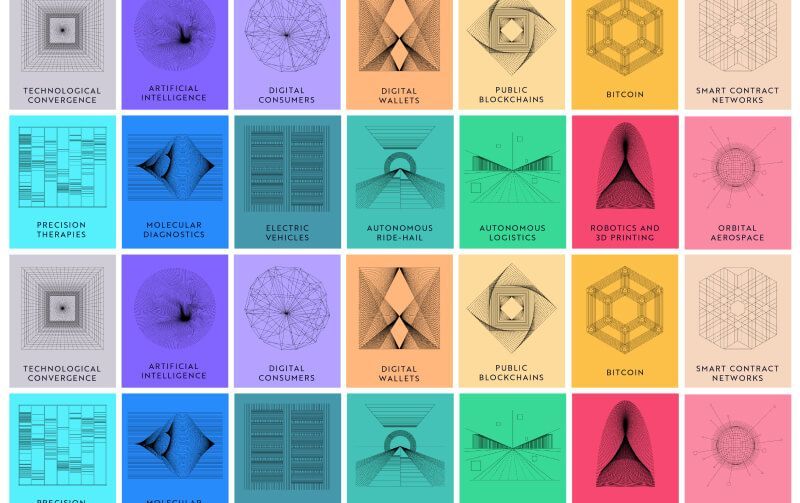

Featured ARK Invest Research

The Bitcoin Monthly - June

#358: Crypto Networks Are Flourishing Amid The ...

Big Ideas 2023

Crypto has been Thriving Amidst A Regional Banking Crisis ...

Introducing Big Ideas 2023